Key Heading Subtopics

H1: Again-to-Again Letter of Credit rating: The whole Playbook for Margin-Dependent Buying and selling & Intermediaries -

H2: What exactly is a Back-to-Back Letter of Credit score? - Primary Definition

- How It Differs from Transferable LC

- Why It’s Employed in Trade

H2: Best Use Circumstances for Again-to-Back LCs - Intermediary Trade

- Fall-Shipping and delivery and Margin-Based Investing

- Production and Subcontracting Offers

H2: Construction of the Back again-to-Back LC Transaction - Main LC (Learn LC)

- Secondary LC (Supplier LC)

- Matching Stipulations

H2: How the Margin Is effective inside of a Back again-to-Again LC - Position of Cost Markup

- To start with Beneficiary’s Income Window

- Managing Payment Timing

H2: Important Events inside of a Back-to-Again LC Setup - Consumer (Applicant of To start with LC)

- Intermediary (First Beneficiary)

- Provider (Beneficiary of Second LC)

- Two Distinct Banking institutions

H2: Necessary Paperwork for Each LCs - Bill, Packing Listing

- Transport Files

- Certificate of Origin

- Substitution Rights

H2: Benefits of Utilizing Again-to-Back LCs for Intermediaries - No Will need for Individual Capital

- Safe Payment to Suppliers

- Handle Above Doc Move

H2: Risks and Troubles in Back again-to-Again LCs - Misalignment of Files

- Supplier Delays

- Timing Mismatches Among LCs

H2: Methods to Build a Back-to-Back LC Appropriately - Securing the First LC

- Structuring the 2nd LC

- Running Differences in Rate, Dates & Files

H2: Widespread Faults to stay away from in Margin-Dependent LC Trades - Overlooking Payment Timelines

- Not Matching LC Terms

- Failing to Foresee Margin Compression

H2: Back again-to-Back vs Transferable LC: An in depth Comparison - Comparison Table

- When to Pick one Above the Other

H2: Purpose of Banks in Facilitating Back-to-Again LCs - Issuing Bank for Consumer

- Intermediary’s Lender as Issuer of 2nd LC

- Doc Regulate and LC Approval

H2: UCP 600 and Authorized Guidelines for Back again-to-Again LCs - ICC Suggestions

- Important Clauses

- Chance Allocation

H2: Real-Earth Illustration of a Margin-Primarily based Trade Applying Back-to-Back LCs - Phase-by-Move Situation Review

- Deal Framework

- Results and Profit Realization

H2: Digitalization and Future of Back-to-Back again LCs - eUCP and Fintech Integration

- SWIFT MT700 Utilization

- Electronic Doc Substitution

H2: Routinely Asked Queries (FAQs) - Can the phrases in the two LCs differ?

- Is margin generally assured?

- Can both of those LCs be through the very same lender?

- Who substitutes the files?

- Am i able to terminate the second LC?

- Are back-to-back LCs legal just about everywhere?

H2: Conclusion - Summary of Ideal Techniques

- Remaining Techniques for Investing Intermediaries

Since the framework is ready, I’ll commence composing the extended-kind write-up making use of this thorough outline.

Again-to-Back again Letter of Credit score: The Complete Playbook for Margin-Based Trading & Intermediaries

What exactly is a Back-to-Again Letter of Credit rating?

A Back-to-Again Letter of Credit score is a smart economical Resource applied principally by intermediaries and investing companies in worldwide trade. It entails two different but linked LCs issued over the power of each other. The intermediary gets a Learn LC from the client and uses it to open a Secondary LC in favor in their provider.

As opposed to a Transferable LC, the place only one LC is partially transferred, a Again-to-Back LC makes two independent credits which have been meticulously matched. This composition permits intermediaries to act without the need of applying their own personal resources whilst however honoring payment commitments to suppliers.

Ideal Use Situations for Again-to-Again LCs

This kind of LC is especially worthwhile in:

Margin-Centered Investing: Intermediaries purchase at a lower price and promote at a better selling price applying joined LCs.

Fall-Delivery Styles: Merchandise go straight from the supplier to the customer.

Subcontracting Scenarios: Where companies supply goods to an exporter managing buyer interactions.

It’s a most popular system for all those without having inventory or upfront funds, allowing for trades to occur with only contractual Management and margin management.

Composition of the Back-to-Again LC Transaction

An average setup consists of:

Key (Grasp) LC: Issued by the buyer’s financial institution for the intermediary.

Secondary LC: Issued because of the intermediary’s bank to the provider.

Files and Cargo: Supplier ships merchandise and submits documents less than the next LC.

Substitution: Middleman may possibly change provider’s invoice and documents prior to presenting to the client’s bank.

Payment: Supplier is paid out just after Assembly problems in next LC; intermediary earns the margin.

These LCs need to be very carefully aligned in terms of description of goods, timelines, and ailments—though charges and portions might differ.

How the Margin Functions in the Back-to-Back again LC

The intermediary revenue by selling items at a better selling price through the master LC than the price outlined while in the secondary LC. This rate difference creates the margin.

On the other hand, to protected this profit, the middleman ought to:

Specifically match doc timelines (cargo more info and presentation)

Guarantee compliance with each LC conditions

Control the flow of products and documentation

This margin is frequently the one cash flow in these specials, so timing and accuracy are vital.

Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Sydney Simpson Then & Now!

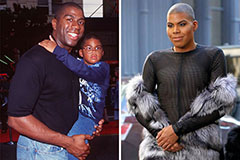

Sydney Simpson Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!